Understanding Business Structures and Tax Filings

Choosing the right business structure is a crucial decision for entrepreneurs and business owners. The structure you select affects everything from day-to-day operations, taxes, liability, and even the ability to raise capital. This guide provides an overview of the main types of business structures in the United States, their associated tax filing requirements, suitability for different scenarios, and the advantages and disadvantages of each.

1. Sole Proprietorship

A sole proprietorship is the simplest and most common structure chosen to start a business. It is an unincorporated business owned and run by one individual, with no distinction between the owner and the business.

Tax Form Filings: The owner reports income and expenses on Schedule C attached to their personal Form 1040.

Suitability: Ideal for small, low-risk businesses and freelancers.

Advantages:

Easy and inexpensive to form.

Complete control for the owner.

Simple tax filing requirements.

Disadvantages:

Owner is personally liable for all debts and obligations.

May be more difficult to raise money and attract investors.

May be seen as less credible by clients and suppliers.

2. Partnership

A partnership involves two or more people sharing ownership of a business. There are several types, including General Partnerships (GP), Limited Partnerships (LP), and Limited Liability Partnerships (LLP).

Tax Form Filings: The partnership files Form 1065. Each partner receives a Schedule K-1 to report their share of income on their personal tax returns.

Suitability: Suitable for businesses with multiple owners, professional groups, or those looking to pool resources.

Advantages:

Easy to establish.

Combines skills and resources of multiple people.

Income and losses pass through to partners for tax purposes.

Disadvantages:

Partners are personally liable (except in LLPs and LPs).

Potential for conflicts among partners.

Profits must be shared.

3. Limited Liability Company (LLC)

An LLC blends features of partnerships and corporations, offering personal liability protection while allowing pass-through taxation by default. Owners, called members, can manage the company directly or appoint managers. LLCs can be single-member or multi-member.

Tax Form Filings:

Single-member LLC: File as a sole proprietorship (Schedule C with Form 1040).

Multi-member LLC: File as a partnership (Form 1065 and Schedule K-1).

LLC can also elect to be taxed as a corporation (Form 1120 or 1120S).

Suitability: Good for medium- to high-risk businesses, owners with significant personal assets, and those seeking flexible management and tax options.

Advantages:

Limited liability protection for owners.

Flexible management structure.

Pass-through taxation (unless taxed as a corporation).

Disadvantages:

More expensive to form than sole proprietorships or partnerships.

State-specific compliance and annual fees.

May be subject to self-employment taxes.

4. Corporation

Corporations are independent legal entities owned by shareholders. There are two main types: C Corporations and S Corporations.

Tax Form Filings:

C Corporation: Files Form 1120. Profits are taxed at the corporate level, and dividends are taxed again at the shareholder level ("double taxation").

S Corporation: Files Form 1120S. Income and losses pass through to shareholders, who report them on personal tax returns via Schedule K-1.

Suitability: Suitable for businesses seeking to raise capital, those planning to go public, or those needing strong liability protection.

Advantages:

Owners (shareholders) have limited liability.

Ability to raise capital by selling shares.

Perpetual existence.

S Corporation provides pass-through taxation (if eligibility requirements are met).

Disadvantages:

More expensive and complex to set up and operate.

Extensive record-keeping and regulatory requirements.

C Corporation faces double taxation.

S Corporation has restrictions on number/type of shareholders.

5. Nonprofit Organization

Nonprofits are organized for charitable, educational, religious, or other activities serving the public interest. They receive tax-exempt status from the IRS.

Tax Form Filings: File Form 990 annually to report income and activities.

Suitability: Appropriate for charitable, educational, religious, or social causes.

Advantages:

Tax-exempt status for qualifying organizations.

Eligible to receive grants and donations.

Limited liability protection.

Disadvantages:

Strict compliance and reporting requirements.

Profits must be used to further the organization’s mission.

Cannot distribute profits to members or directors.

Conclusion

The choice of business structure depends on your goals, risk tolerance, financial situation, and plans for growth. Sole proprietorships and partnerships offer simplicity, while LLCs and corporations provide liability protection and greater flexibility. Nonprofits serve public interests with specific compliance requirements. Consulting with legal and tax professionals is recommended when making this important decision.

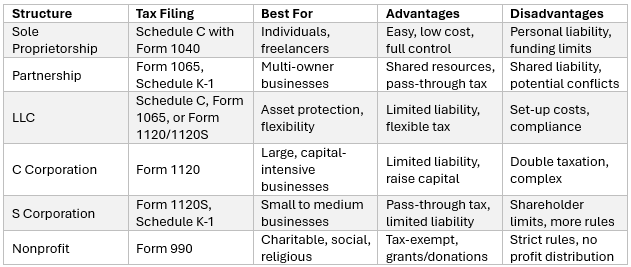

Summary Table: Business Structures at a Glance